DeCredit – Decentralised Credit Platform with DAML

Introduction

NashTech built a direct lending platform to remove the need for intermediaries of traditional lending processes, leading to easier regulatory reporting and compliance providing and end to end flow transparency.

The challenge

The current lending process is afflicted with less transparency and less visibility into the end-to-end process for a user. Traditional lending processes also involve third-party organisations requiring more time and higher fees. The entire process would also take days, sometimes weeks, to be processed. NashTech wanted to build a direct lending platform to solve these challenges and make the lending process more efficient. What we had in mind was reduced cost by removing the need for intermediaries, quick resolution of the lending process, and providing flexibility in interest rates.

The solution

Our solution came from a direct lending platform where legal agreements can be established, repayment can be completed, and relevant changes can be updated to a shared ledger in real-time while maintaining confidentiality as needed. DeCredit is a DAML-powered decentralised loan lending application backed by digital collaterals in a peer-to-peer network. The borrower in need of money can create a profile on the platform and initiate a loan request by setting one of their digital cryptocurrencies as a collateral. DeCredit also supports other types of collaterals that reside offline. The lenders can check the existing loan requests, and based on the risk assessment, propose the amount and a desired rate of interest. The borrower can then choose from among the various proposals received and select the one that suits their needs.

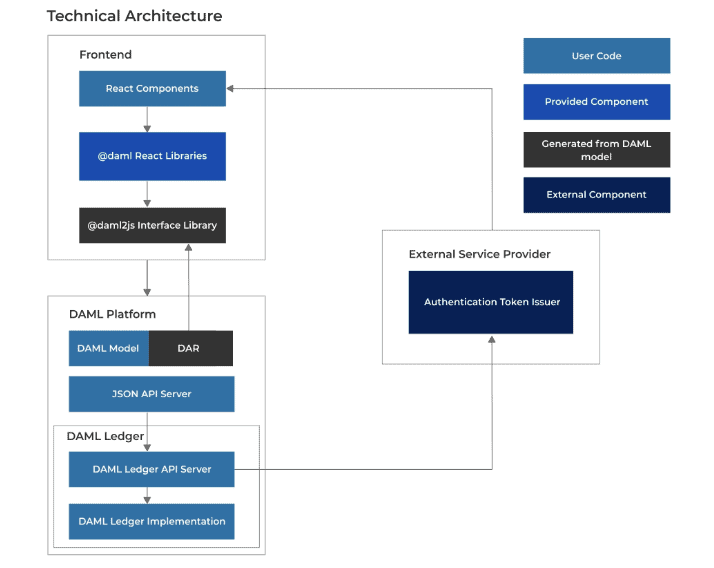

Technical Architecture

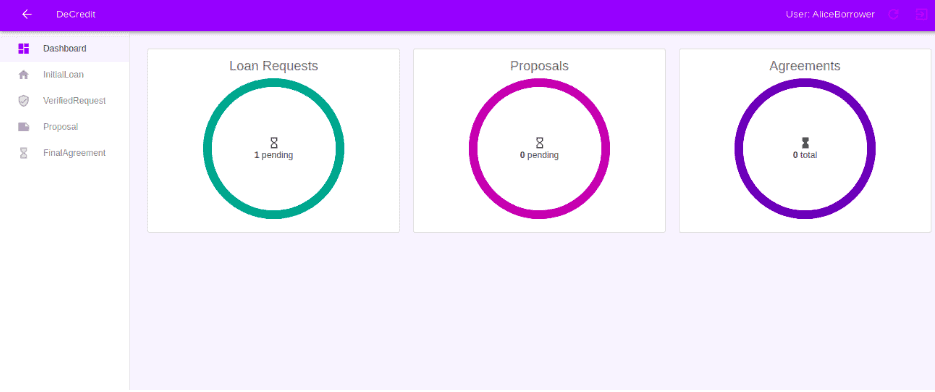

Here is a quick view of the Borrower Dashboard:

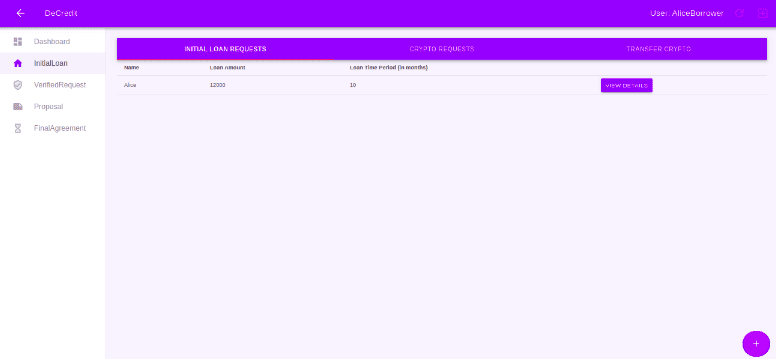

Borrower Loan Requests:

The outcome

- Direct lending between borrowers and lenders.

- Real-Time loan transactions.

- Use of cryptocurrency as a collateral.

- End to end flow transparency.

- Easier regulatory reporting and compliance.

Read more case studies

Modernising legacy systems and driving efficiencies through partnership with RPS Under Dev

Explore how NashTech help RPS modernise legacy systems and drive efficiencies through partnership

Modernising legacy systems and driving efficiencies through partnership with RPS

Explore how NashTech help RPS modernise legacy systems and drive efficiencies through partnership

Supporting digital shelf analytics and unlocking eCommerce growth

Explore how NashTech help the digital shelf analytics and unlock growth with a world leading data insights and eCommerce solutions provider.

Let's talk about your project

Our partnerships